Is Bitcoin a fraud? (Part 2)

- 투자전략

- 2021. 10. 18.

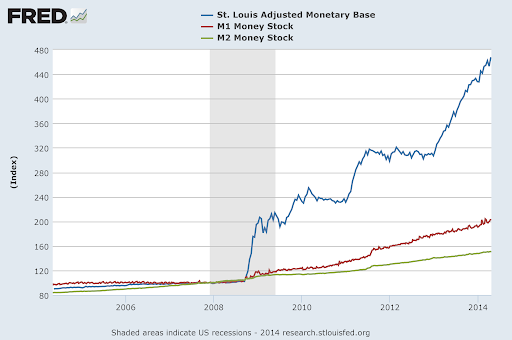

We overcome the 2008 financial crisis with tremendous money release. The release of money continues until now in 2021. Now, the world is implementing another huge release of money due to COVID-19.

We receive money in return for working hard with sweat. Sweaty labor is symbolic and in any case, we receive "money" for our efforts. It's the same for everyone, whether it's a business or a worker.

What if the number of currency released in the world suddenly increases? Yes, that’s right. The value of money falls. If the value of money falls, of course you should be compensated for the decline. But did your income increase as much as the amount of money released to the world?

When the money volume doubles, the value of the cash is actually halved. As the amount of calls increases, salary workers should increase in proportion to that. But that's not the case in reality, is it? The current monetary system is just sitting still and being robbed of my wealth.

As mentioned earlier, the current monetary system is linked to the dollar, and this dollar is a paper that they print freely in a group called FED. It gives faith to this paper and stores value. In a way, isn't it more of a buy than Bitcoin?

Now let's go back to Bitcoin. Bitcoin is limited to 21 million units. In addition, the amount of mining is set to decrease over time. It also takes a lot of energy to mine Bitcoin.

Is it only humans who sweat and work to get rewards? But is it reasonable to believe that if someone can print the results of working hard and receiving them arbitrarily? Bitcoin consumes enormous energy to generate Bitcoin. It's different from just taking pictures. Of course, this can cause additional problems.

If a repository of values, a medium of exchange, is easily created. It's like a stone on the street. But the problem is that the current monetary system is returning to a structure that is no different from these stones on the street. Very cleverly without even noticing that.

Gold has been a repository of values that mankind has believed in since ancient times. It can be easily divided into scarcity and immutability. Some people say this. Gold is not a storage of value, but an industrially useful metal. However! If you think about it a little bit, it has nothing to do with why gold became valuable. Gold is used in the industry in modern times, and since ancient times, when electricity was not used, gold has been used as a repository of value and a medium of exchange.

When I look at Bitcoin from the concept of modern currency, I think it's a fraud. A lot of people claim it's Ponzi scheme, right? For that reason, the luxury bag is also Ponzi scheme, and the precious metal is Ponzi scheme. Many people keep asking questions that go against the points about where Bitcoin is useful. Then I'd like to ask you again. What kind of usefulness do luxury bags have in our lives? Why are natural diamonds so expensive? What about Ruby? Sapphire?

Everything comes from "belief" absurdly. The dollar is just printed, but everyone "believes" that the value is stored there. Natural diamonds and industrial diamonds have exactly the same ingredients, but I just believe that natural diamonds will have higher value. Bitcoin also has faith, so cash bonds are recognized for tens of millions of won per unit.

If Bitcoin wasn't worth it, the world wouldn't have gone crazy with it. No one disputes whether it is valuable or not for rocks on the street. The debate itself is that Bitcoin is already recognized for its status. In addition, Bitcoin has a technical advantage that almost perfectly compensates for the shortcomings of precious metals (continued in Part 3).

'투자전략' 카테고리의 다른 글

| 스태그플레이션 시대의 주식과 부동산 투자 (0) | 2021.10.19 |

|---|---|

| Is Bitcoin a fraud? (Part 3) (0) | 2021.10.19 |

| Is Bitcoin a fraud? (Part 1) (0) | 2021.10.17 |

| Collect seed money and invest? Silly! (0) | 2021.10.16 |

| What's wrong with Elon Musk? (0) | 2021.10.15 |